If you have been looking for the best method to send money to businesses or marketplaces as well as receive payments, then you must have probably come across the two popular online payment services – Payoneer vs Skrill.

In this article, we’ll be making an honest comparison between the two companies to help you decide which one is best suited for your needs and requirements. We’ll be covering several factors such as exchange rates, security & credibility, fees, ease of use, countries, etc.

Without further ado.

What is Skrill?

Skrill – online payment company was launched in 2001, and since then, it has been helping its customers make transactions and send money to several countries across the world. At present, the Paysafe Group owns the company. Paysafe Group is a multinational payments group that offers payment services in person, online, and through other channels.

Initially, Skrill started as a payment gateway for eCommerce and was specialized in gambling. However, the company has broadened its services and now it offers an online service referred to as the Skrill Money Transfer. It enables you to transfer payments around the world.

Skrill Money Transfer service is simple, fast, and affordable due to its attractive pricing, fees, and exchange rates. When you sign up with Skrill, you’ll have access to this service along with Skrill Wallet (we’ll be talking more on that below).

You can transfer money overseas by using the Skrill Money Transfer service and even fund the payment either with your credit/debit card, bank transfer, or SOFORT, depending on your location and your currency.

The payee can opt to receive their payments into their accounts directly. Aside from that, Skrill also offers beneficiaries of certain countries the option to receive funds into their mobile wallets.

What is Payoneer?

Payoneer is another online payment company, which is located in New York. Established in 2005, the company can process online transactions for both the US as well as overseas users. It has over 4 million users in more than 200 countries worldwide. The company can also facilitate cross-border payments in over 150 currencies.

Payoneer’s services are used in various major eCommerce marketplaces like Upwork, Airbnb, Fiverr, Google, and Amazon. If your organization needs to transfer or receive funds either internationally or domestically, Payoneer’s services can be beneficial.

Payoneer mainly focuses on currency conversions, receipts, and business payments. As such, the services it offers are slightly different compared to the traditional currency exchange providers. It depends on your and the payee’s Payoneer account status.

Its services work best for businesses, professionals, product/service marketplaces, and freelancers that work with international clients a lot. It’s also quite beneficial for companies that make or receive several B2B payments.

Payoneer vs Skrill: Products & Services

To understand how Skrill and Payoneer differs from each other, let’s dive deep into features that both companies provide to the community worldwide.

Payoneer’s Features & Services

When it comes to products and services, you need to note that Payoneer isn’t like the standard merchant account provider. It doesn’t provide the full range of services you’d normally get from traditional providers. As such, you can’t use the POS system or the credit card terminal via your Payoneer account.

The company also doesn’t have any support for a virtual terminal or a payment gateway. Here are some of the features Payoneer offers:

Payoneer account

Payoneer’s Global Payment Service provides a Payoneer account to its users. This account enables you to accept funds in various currencies, and whenever someone sends a payment, it’ll be transferred to your Payoneer account.

It also allows you to transfer money to other Payoneer users across the globe, for free. Do note that Payoneer’s services are not tailored for personal use but for just business transactions.

Payoneer’s Billing Service

Payoneer’s Global Payment service and its billing service work alongside each other. Therefore, requesting business payments requires a few clicks, allowing you to transfer it to your customers quickly.

The clients can then pay the invoice or bill with their debit cards, credit cards, or bank account. They don’t need to have a Payoneer account to transfer the money. Once they make the payment, it’ll be sent to your Payoneer’s receiving account. There are, however, certain restrictions you need to be aware of (find out here).

Payoneer’s Prepaid Mastercard

The company also offers prepaid MasterCard to its account holders, which is used for making payments once your Payoneer account has sufficient funds. Additionally, it charges a yearly fee of $29.95 for this card. The price is quite a lot, especially if you don’t use your Payoneer account frequently.

Mobile App

It provides a free Payoneer app with limited functionality. The app is compatible with both android and IOS devices. It enables you to withdraw funds, check your transaction history, instantly check account balance and currencies, and preset criteria by filtering key transactions.

- Withdraw funds: To access your Payoneer funds, it enables you to transfer it to the local bank account and can be converted into the local currency. You can even withdraw the money via the ATM or a prepaid card.

- VAT Services: The company allows businesses to transfer VAT payments to authorities in the UK and the EU with EUR and GBP funds in the user’s Payoneer account.

Partner directory

Features several integrated services across various niches. The partner directory of Payoneer features all of those businesses and services.

Integrated Payments Platform

The company allows business owners to make use of its payment platforms via a comprehensive API. This makes it easier for them to transfer or receive funds worldwide without having to leave the business’s website.

Now that you know some of the best features Payoneer offers its customers, let’s have a look at what Skrill has in store for its users to help you determine how Payoneer vs Skrill differs in terms of products and services.

Skrill’s Features & Services

Skrill offers the following two merchant services:

- Skrill’s wallet payments:

You’d expect, Skrill allows businesses to accept funds from anyone who uses the digital wallet.

- Skrill’s hosted payments: This service lets you receive funds from both Skrill users and non-users. When they check out from your site, they are redirected to the website to complete their transaction, which is quite similar to how PayPal works.

Also offers an inframe to accept funds via Skrill while keeping the customers on your site. Skrill boasts that its hosted payment solution can support over a hundred local payment methods & more than 170 bank transfers directly by using a single integration.

Here’s a list of some of the features Skrill offers:

Skrill 1-tap

1-tap feature enables users of the Skrill wallet to accept purchases automatically, without the need to go through the authorization process every time.

Shopping cart integration

Offers merchants the option to integrate with a wide range of shopping carts. Some of the notable ones include Shopify, BigCommerce, Volusion, OpenCart, and WooCommerce.

Recurring payments

This feature is not as advanced as some of the tools you’d get in other merchant services, it’s still an excellent option for membership and subscription.

Mass payments

Offers a mass payment feature that enables users to transfer money to several people at once.

In-app microtransactions and payments

Allows developers to facilitate transactions in online apps, specifically within games.

Skrill’s prepaid Mastercard

With this prepaid card you can access your account balance for making any payments worldwide, wherever MasterCard is accepted. You can know more about its prepaid card here.

Skrill’s mobile app

Skrill offers an application for IOS and android devices so that you can use your Skrill wallet and account, wherever you are. The app enables you to check your balance, upload and withdraw funds, transfer or accept money, and make a transaction with Skrill’s prepaid Mastercard.

- Additionally, it is also worth noting that it is PCI-compliant. However, you don’t have to worry as you do not host your own transaction page. Skrill also enables you to have access to its analytics. It may seem pretty basic, but it helps you to be aware of your processing volume.

- Skrill doesn’t offer in-person payments. It is strictly mobile and online only. Another downside of Skrill is that there is no invoice support for users in the US.

Skrill vs Payoneer: Pricing, Fees & Exchange Rates

One of the most crucial factors that will help you in determining whether Skrill or Payoneer is ideal for you is their fees. We are not talking about just transfer fees, but other charges associated with withdrawing and depositing funds and their exchange rates.

Skrill Pricing, Fees & Exchange Rates

When it comes to depositing funds, Skrill will charge you a fee of one percent, meaning if you deposit £500 to your account, you’ll have to pay a £5 fee. As far as withdrawing fees are concerned, you’ll have to pay £4.82 via your Skrill wallet.

If you wish to withdraw money from your Skrill wallet back to your debit or credit cards, then you’ll have to pay 7.5%, meaning a £100 withdrawal will cost you £7.50 in fees.

Transferring money with Skrill will charge 1.45 percent of the amount transferred. On the contrary, Payoneer’s fee structure is what makes it quite popular among affiliates and freelancers. When you receive payments through your receiving account, you won’t have to pay any additional fees.

Payoneer Pricing, Fees & Exchange Rates

That said, Payoneer does charge a fee for USD (0%-1%), depending on the payer’s country. Also, there’s a 3% charge for receiving payments via debit or credit card and a 1% fee (for eCheck in USD). For transferring funds to your account, there’s a 2% fee above the mid-market rate. You can have a look at the image below or check their fee page.

When it comes to exchanging rates, Skrill charges a fee of 3.99% whereas Payoneer users are subject to paying a fee of 0.5%, above the interbank exchange rate.

Also, Skrill pricing is easier to understand because of the website structure they have created. While on the other hand, there are no Payoneer’s pricing section on their website which can be confusing for non-registered user. Not to mention, overall pricing for specific transactions can vary from country to country.

Skrill and Payoneer: Contract Length and Cancellation Fee

The next factor that we’ll be talking about in our Skrill vs Payoneer comparison is the contract length and cancellation fee of both the platforms.

Payoneer charges on a monthly basis and doesn’t require its users to sign any long-term contract. Also, there isn’t any early cancellation fee when you close your account. However, it is recommended that you follow its account closure procedure as outlined in the contract to make sure that your account has been terminated for real.

Payoneer’s flexibility in offering a monthly-billing option is commendable. However, as we have mentioned before, you still need to pay the annual fee. Although this fee is actually supposed to be a payment for the Payoneer debit card, setting up an account isn’t possible without this card.

Therefore, the annual fee is quite similar to the account fee that most merchant payment service providers charge. But if you compare Payoneer vs Skrill, Skrill service is more of a pay per transaction basis, where merchants have to pay per usage. Depending on its additional agreements, business accounts may have to pay other monthly fees. Like Payoneer, there isn’t any early cancellation fee for Skrill as well.

Skrill vs Payoneer: Customer Service & Support

When it comes to customer support or service, both platforms do a pretty decent job. They both have their own support center available on their website.

If you need any assistance while using your Skrill account, it’s worth going through their large FAQ section first. Most account related queries can be answered by checking the extensive guide that’s on offer.

If you wish to interact with the team directly, there are quite a handful of options at your disposal. Firstly, you can contact Skrill via telephone. The company offers several local phone numbers, which include that of the US and the UK.

Before contacting them, you need to have your reference number (you can find it on the top-right). This enables the support agent to bring up your account.

You can also message the customer support team directly using your Skrill account. You can expect to hear back from them within 24 hours, but, if you require instant support, contacting via telephone is preferable.

If you happen to be a VIP Skrill member, you can have access to its 24/7 customer support by using their dedicated phone number. As such, you won’t have to worry about any delay. Unfortunately, it doesn’t offer a live chat option.

Similar to Skrill, Payoneer features an efficient Support Center on its site. You will find an extensive FAQ segment containing detailed and thorough information for answering any queries and troubleshooting issues.

Get access to the live chat feature by signing in to their Payoneer account. You can also get in touch with the team via email. The telephone support, however, is only intended for reporting stolen or lost debit/credit cards.

The live chat option is available in three languages, namely, English, Russian, and Spanish. If you aren’t familiar with these languages, you are better off with the email option as it features plenty of additional languages.

Overall, both companies provides quick customer support.

Skrill vs Payoneer: Credibility & Security

Payoneer vs Skrill – can they be trusted? The short answer to this is yes. Here’s why:

Formerly known as Moneybookers, Skrill has been running since 2001. They are fully regulated and authorized and have millions of users to back their credibility. They have been helping users make domestic as well as overseas transfers and even make online payments with ease.

Its owner, Paysafe, has offices in more than 20 locations worldwide and that includes the USA and the UK.

On the other hand, Payoneer may be relatively new in comparison to Skrill. However, it has still managed to win the trust of millions when it comes to making payments online.

Developed in 2005, Payoneer is backed by Expedia and Dropbox, the very investors that funded Facebook. Ever since its establishment, Payoneer has over a thousand employees worldwide, located across fourteen offices all over the world.

Several marketplaces, individuals, and companies use Payoneer’s services to receive and make payments and also to transfer funds across the globe.

All of these prove that both platforms are legitimate and can be fully trusted.

Comparing Payoneer vs Skrill, who do you think can be trusted more? Write your comments below.

How To Send Money From Skrill to Payoneer?

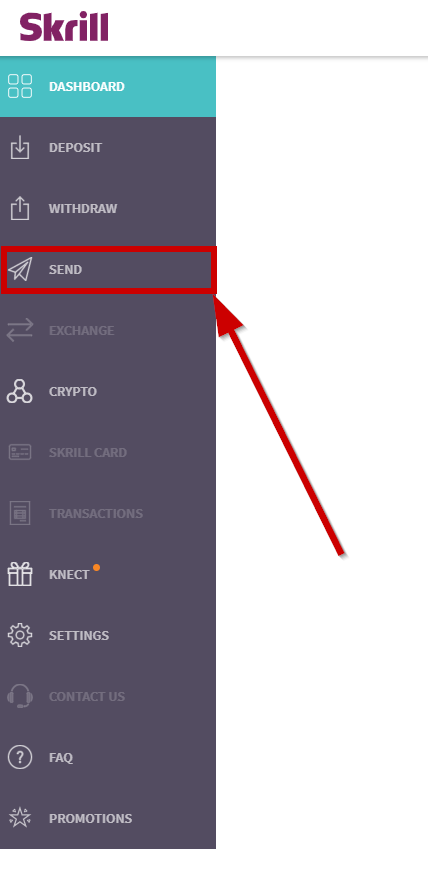

1st Step: Log in into your account and move to Send section

Log in or create a new Skrill account and go to “Send” to choose between “Skrill to Skrill” or “Skrill Money Transfer” options.

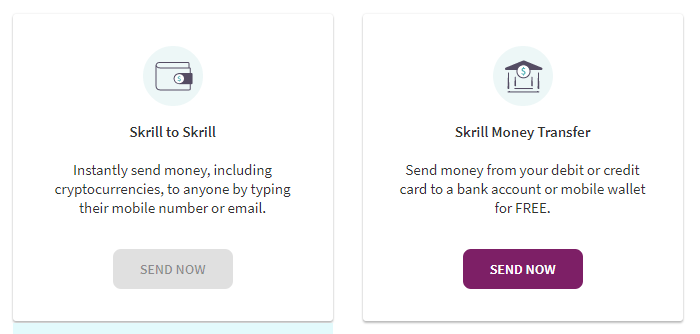

2nd Step: Select payment method

Pick between the best option. Note that sending money to Skrill will be a lot faster and cheaper than sending money to different bank accounts.

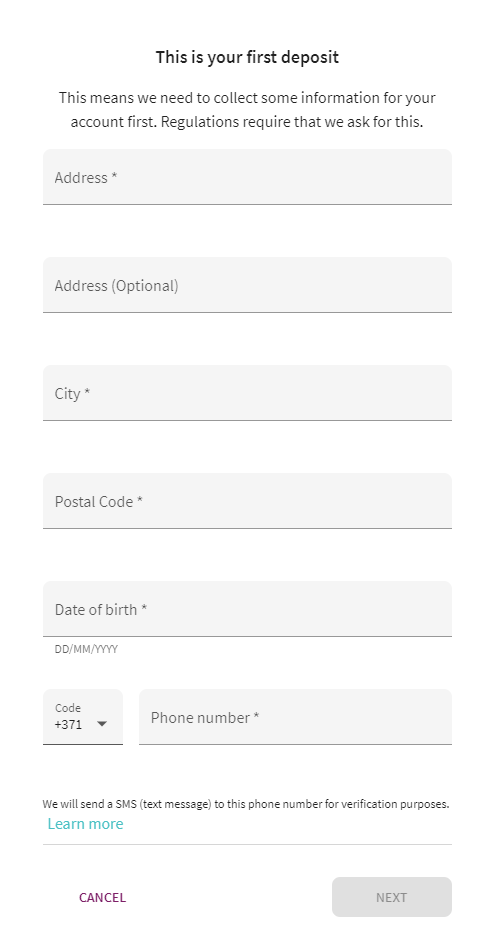

3rd Step: Enter personal details if you are first time user

You will be asked to enter personal details to fully enable all the features of Skrill. This step is necessary as you won’t be able to send money from Skrill to Payoneer or any other bank accounts.

4th Step: Enter your recipient’s details and confirm the amount

This step is straightforward and you will be guided through-out the Skrill’s transaction process to make your life easier.

How To Send Money From Payoneer to Skrill?

It take only a couple of steps to transfer money from Payoneer and most likely – you have already done them.

But if not, let’s take a look at how you can send money from your Payoneer to Skrill or any other bank account.

1st Step: Go to Bank Accounts in Settings (top-right corner)

2nd Step: Navigate to Pay and then Make A Payment

3rd Step: Add Skrill or any other recipient’s bank account

After you have added the recipient account – you will have to wait for the approval of the recipient, but it usually doesn’t take long and quickly enough you will be able to make payments.

4th Step: Choose recipient and make a payment

5th Step: Send money from Payoneer to Skrill

In the last step you’ll have to choose from which account you want to make a payment, add recipient’s details and enter the amount you want to send.

Skrill vs Payoneer: Pros & Cons

Skrill Pros:

- Skrill Money Transfer offers very competitive exchange rates and fees.

- Excellent user reviews on Trustpilot.

- Convenient, secure, and fast transfers via Skrill Money Transfer.

Skrill Cons:

- You can only transfer funds to the mobile wallet or bank account.

- Available in limited countries.

- High fees.

Payoneer Pros:

- Offers extensive payment services & solutions.

- Reasonable currency exchange fees.

- Quick transactions from anywhere across the world.

Payoneer Cons:

- Stringent terms & conditions for using its service.

- Currency conversion only meant for business payments and transactions.

- Lots of additional fees.

Skrill vs PayPal vs Payoneer vs TransferWise

It’s hard to compare Skrill vs PayPal vs Payoneer vs TransferWise because of their high competitiveness. All companies have pros and cons, and they most likely will depend on the country you live in and financial goals you have set.

Nonetheless, you can take advantage of all of these different online banks to benefit your needs.

Skrill vs PayPal vs Payoneer vs TransferWise – Transfer Speed, Fees & Benefits

- Transferwise compared to Skrill or PayPal or any other company offers fixed fees, which can be useful from certain purposes

- Minimum transfer amount starts from only $1

- Transfer fee can vary from 0% to 0.5%

- You can order Transferwise borderless debit Mastercard

- Minimum transfer amount for Skrill is $1 and you can do even less but it’s not really worth it because of the fees.

- Most of these banks offer highly competitive transfer speed and it usually takes a couple of minutes but as stated in the Skrill’s terms and conditions, transfer can take up to 3 days.

- The ugly side to Skrill – transaction fee is 1.9% which may not be high depending on the country you live in but exchange rates and withdrawal fees are the scariest parts. Your withdrawal fee can rise as high as 7.5% and currency conversion will take a chunk of 3.99%.

- Paypal fees sometimes can be rude, depending on the country

- Fees can vary by a high percentage depending on the transfer conditions

- Exchange rates have mid-market rate plus 2.5% margin

- Paypal transfer speed highly excels compared to other competitors

- When receiving money, transfer fees can charge up to 1%

- The minimum amount you can transfer is $20 which may seem like a big starting point. But in case you are US customer – minimum transfer amount will be $50.

- As an individual, you won’t be pay able to make overseas payments to anyone, unlike what TransferWise offers

- Good for freelancers and business owners

Final Verdict: Payoneer vs Skrill – Which is better?

To determine a winner between Skrill vs Payoneer, it will ultimately depend on your personal needs and preference and your location.

If we were to pick a winner, it’d be Payoneer. It is an excellent tool for international businesses and freelancers. Its ability to manage currency conversions and transfer payments to bank accounts worldwide makes it a compelling choice for most users.

Payoneer is an ideal choice to go for if you do international business or are just looking for a platform to make currency conversions and transfer payments.

That’s not to say that Skrill is any less; it is a beneficial tool for sending and receiving money online. It allows you to transfer funds anywhere around the world. However, it’s more on the expensive side.