Did you know BlockFi can help you make money while you sleep?

At least, that’s the promise!?

So, in this BlockFi Review you will find out how much of it is true.

BlockFi Review

To give you an overview BlockFi pros and cons, here is overview on their offering:

Features Summary | |

Earn Monthly Interest on Crypto Holdings | Annual percentage yield is from 6% to 9.3% |

Above-average Compounding Interest Rates | |

Crypto-backed Loans | |

No-fee Crypto Trading platform | |

Regulated and Licenced Financial Platform | |

Bitcoin Rewards Credit Card (coming in 2021) | |

Responsive Customer Support | |

Minimum Depost to Get 20 USD Bonus | $100 |

Ease of Use | |

Overall Rating | |

In case you are ready to Sign-up get your BlockFi Bonus, hit the Red Button.

Or if you need a more detailed review, keep on reading.

Why BlockFi?

Cryptocurrencies have been all over the news lately, and rightfully so.

After a year of stellar performances, investors all around the world are flocking the markets to purchase some of these incredibly profitable assets.

And while trading seems to be the best way to make quick profits with crypto, it certainly isn’t for everyone. It’s risky and requires extensive technical knowledge to be remotely successful.

That being said, there’s another, much easier way to start making profits from your crypto holdings – crypto lending platforms.

Hence, in this article, you will find out everything there is to know about BlockFi:

- How to create a new account,

- Is BlockFi Safe, and if your money is insured,

- Review of Staking account and how to make interest on your crypto,

- As well as reviews of BlockFi trading account, crypto-backed loans, wallet, and the upcoming BlockFi Credit Card,

- Last but not least, you will find the BlockFi referral code near the end of the article.

So, let’s dig in.

How to create a BlockFi Account?

Creating a BlockFi interest account BIA is pretty straightforward:

Either visit the BlockFi website or install the app on your smartphone.

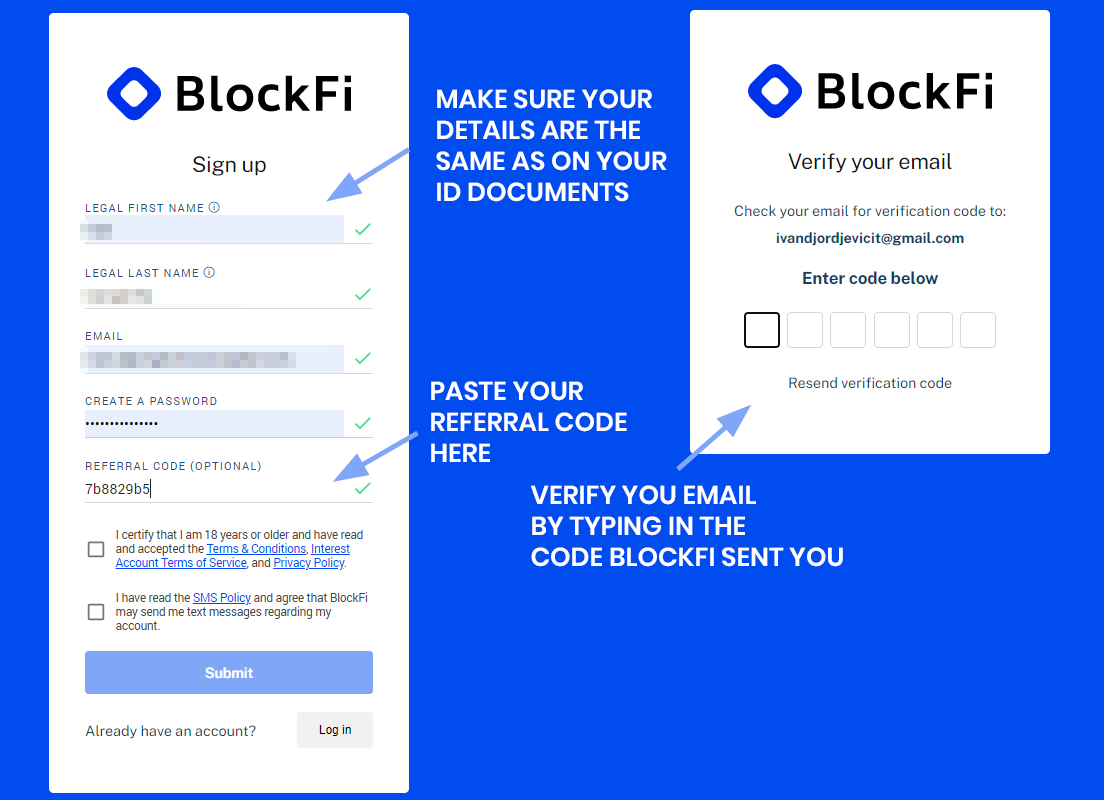

Step 1. Type in your credentials in the required fields and the referral code 7b8829b5.

Step 2. Type in the code you received in your inbox to verify your email.

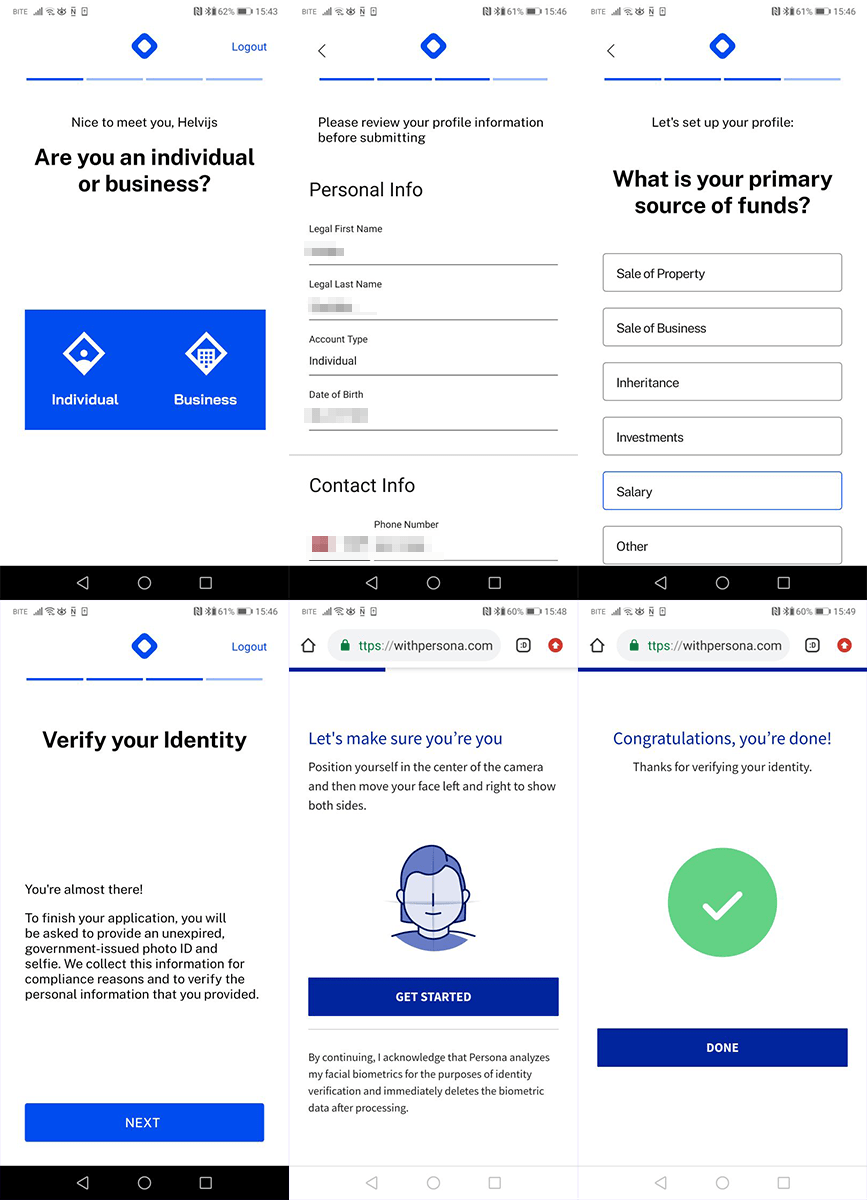

Step 3. Choose your account type.

Step 4. Enter your region and address.

Step 5. Follow the KYC process to verify your ID

Blockfi excels at ease of use because this process from start to finish takes 5-10 minutes.

Now a bit of their background.

What is BlockFi?

Founded in 2017, BlockFi is a cryptocurrency savings platform that offers its users a way to profit from their crypto assets by earning interest on a monthly basis.

BlockFi offers 3 main features to its users:

- Interest on cryptocurrency deposits – users can earn up to 9.3% interest on their holdings per annum. BlockFi makes this possible by lending these deposits to borrowers that pay an interest rate to BlockFi, which, in turn, pays its users for providing the funds.

- This enables Blockfi make money and benefits users to earn interest on their crypto assets.

- Crypto-backed loans – users can deposit crypto on their account as collateral and borrow up to 50% of the collateral value in USD. This way users can get access to cash quickly, without selling their crypto.

- Streamlined Cryptocurrency trading – BlockFi offers its users a way to buy and sell some of the top cryptocurrencies within their app, without any additional fees. However, while the no-fee approach is commendable, you will still be paying higher exchange rates compared to traditional cryptocurrency exchanges like Binance or Coinbase.

All in all, BlockFi is a good way to start making passive income with your crypto and do more with your crypto holdings. But how safe is it really?

Is BlockFi safe?

Many crypto holders have transferred their investment from fiat to crypto for the increased security and control that cryptocurrencies offer. But does BlockFi push the right buttons when it comes to safety? Let’s find out.

Is BlockFi Legitimate business?

BlockFi’s main custodian is Gemini, a global cryptocurrency exchange that was founded by the famous Winklevoss brothers.

Additionally, the fact that some world’s top investors have backed the platform shows us that BlockFi is not a scam. Some high-profile backers include Consensys Ventures, Galaxy Venture capital, and Morgan Creek Digital.

BlockFi CEO Zac Prince often shows up in interviews, so in our view, this cements the legitimacy of the company as scammers rarely show their face on mainstream media.

Is BlockFi regulated?

BlockFi is a registered company with the US Department of Treasury Financial Crimes Enforcement Network (“FinCEN”) as a money services business (“MSB”). That means that it complies with the Bank Secrecy Act and must assist governments with detecting and preventing money laundering.

For this reason, new users are required to pass through an identification verification procedure known as KYC.

Is BlockFi FDIC insured?

Unfortunately, funds deposited in your BlockFi account aren’t insured by the FDIC or the SIPC, meaning that it’s not as safe as putting your money in a bank. The same is true for its custodian, Gemini.

However, Gemini does take additional security measures in relation to your funds:

- More than 90% of the funds are stored in cold storage.

- Gemini has recently received a SOC2 Type 1 compliance certificate following an audit from Deloitte for their custody solution.

- BlockFi states that in case of loss of funds due to a hack, user funds are prioritized over equity or employee funds.

Has BlockFi been hacked?

In May 2020, the BlockFi platform was compromised through a sim-swap hack. Hackers gained access to private user data such as users’ names, email addresses, dates of birth, address, and activity history.

That being said, the report published by BlockFi following the attack confirmed that no funds and public information such as security numbers or passwords were leaked to the hackers.

To conclude, we can say that BlockFi is quite safe when it comes to storing your funds. As with all centralized platforms, there’s always the risk of a data breach. However, your funds should be completely safe, considering the measures taken by custodian Gemini.

BlockFi Interest Account and Staking Review

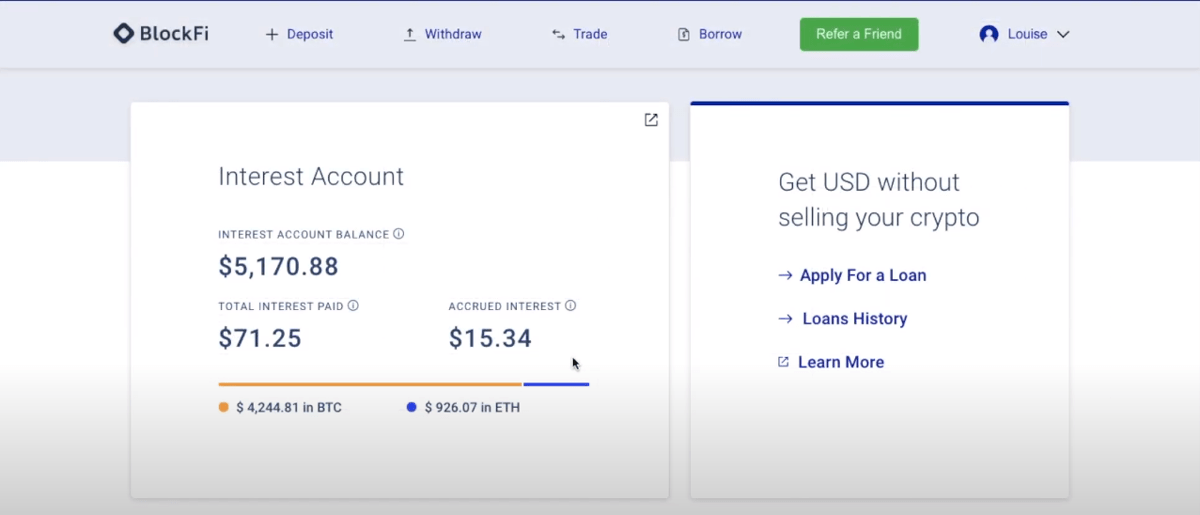

The BlockFi interest account is their primary product that made this cryptocurrency investing platform so popular.

It allows you to store cryptocurrencies on BlockFi platform and earn interest on your holdings.

In more simple terms, you hold money, get compound interest, your assets grow, and you get more interest.

But how is that possible?

How does BlockFi Interest Account work?

The BlockFi interest account functions similarly to a bank’s savings account. The deposited cryptocurrency is lent by BlockFi to other users and in return, you receive interest for providing liquidity to the platform.

There’s no minimum amount to begin earning interest, so you can get started with as little as $50 (or less!).

How can I stake money on BlockFi?

To begin staking money on BlockFi you need to deposit some funds into your account. This can be done through 2 different payment methods:

- Deposit USD to your account through a wire transfer. When going through this method, you are actually purchasing the GUSD stablecoin and depositing it on your account.

- Deposit supported cryptocurrencies from your personal wallet.

Check out the video below detailing this procedure:

Once your funds are in your BlockFi account, your interest rates kick in and begin their monthly countdown. Interests are measured on a daily basis but are paid out once per month. On the first business day of each month, interest is paid out directly in your wallet and compounded to your existing funds.

This means that the following month, you will be automatically investing your initial capital + the interest, increasing your potential gains at every payout!

BlockFi fees

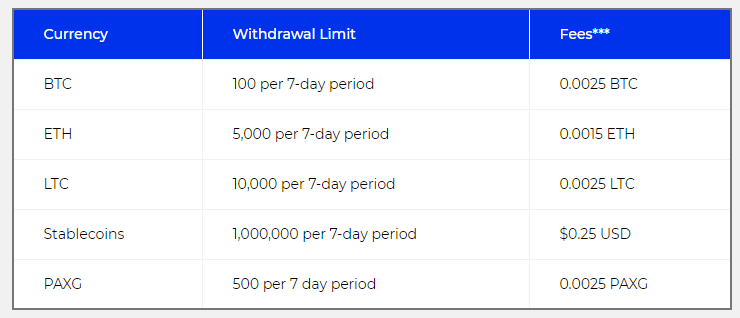

Every BlockFi interest account owner has access to one free cryptocurrency withdrawal per month as well as one free stablecoin withdrawal per month.

Once you have reached that limit, the platform charges you the following fees for each subsequent withdrawal:

In addition to the fees that you need to pay, keep in mind that each cryptocurrency has a different withdrawal limit per 7 day period, as depicted in the table above.

BlockFi interest rates

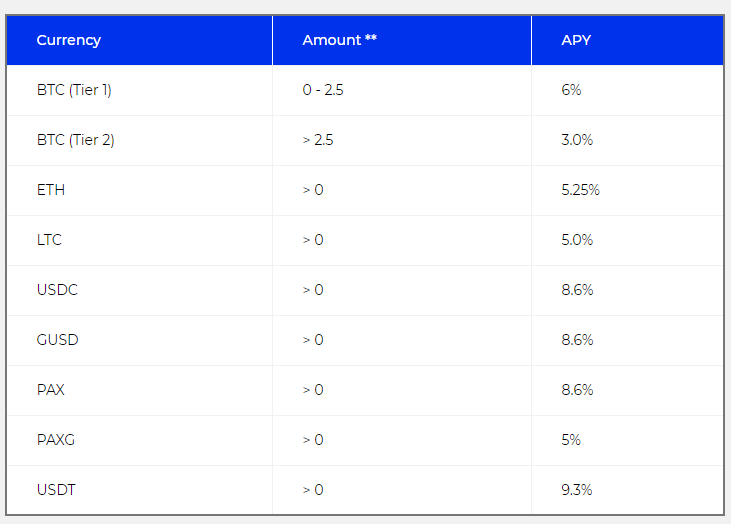

Depending on the cryptocurrency you’ve deposited, different interest rates are applied to your earnings. Check out the table below for more detail:

A key takeaway is that stablecoins net you higher interest rates than cryptocurrencies such as Bitcoin, Ethereum, or Litecoin. However, keep in mind that these stablecoins are pegged to the dollar, and will never increase in value on the market.

So, while being the safer option (less volatility) they ultimately present a lesser opportunity to make profits in the long run.

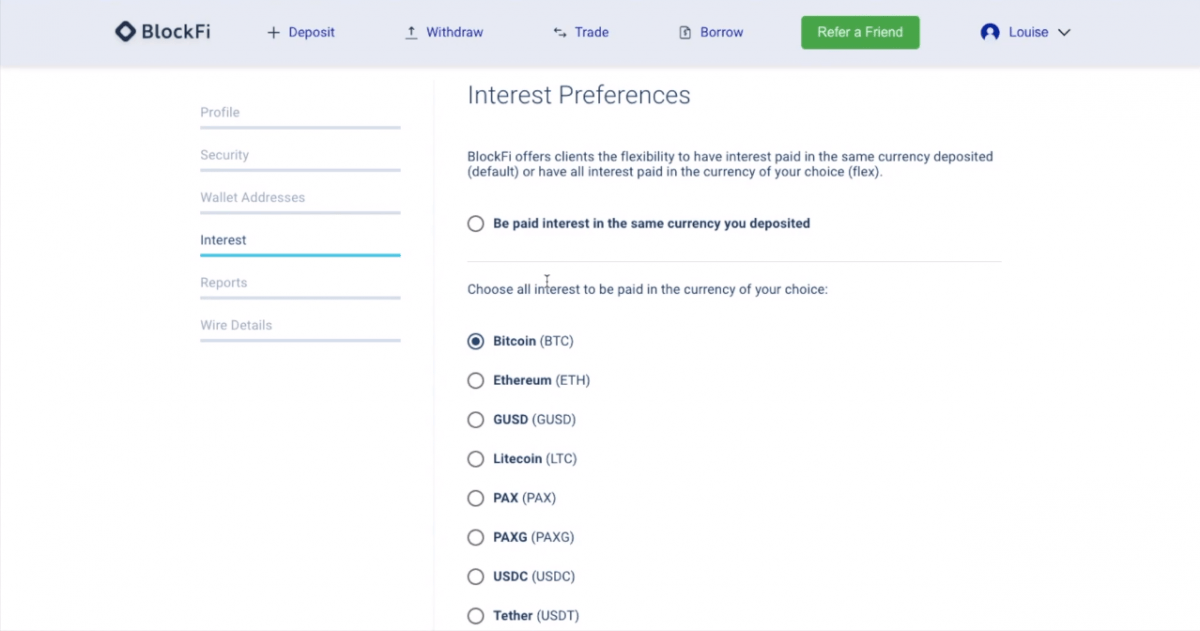

And finally, unlike other platforms, BlockFi allows you to choose your payout currency. So you can deposit stablecoins or Ethereum and earn interest directly in BTC. this can be done by simply selecting your crypto of choice in the “Interest Preferences” tab.

BlockFi Trading Account Review

Now, let’s explore the BlockFi Trading Account feature.

The BlockFi lending platform allows its users to trade top-rated cryptocurrencies between each other, without any fees.

This feature allows you to swap between cryptocurrencies within the BlockFi platform itself, without having to transfer your funds to an external exchange. While the exchange rates aren’t the best on the market, it’s still quite convenient to have this feature directly integrated into the platform as it’s fast, reliable, and exempt from any fees.

An additional benefit of using this feature is that you never stop to earn interest, as the funds never leave your BlockFi wallet in the first place.

How to use BlockFi Trading account?

To use the BlockFi trading feature, simply click on the “Trade” link on top of your dashboard. You will be met with a popup where you can choose the type of crypto and the amount you wish to exchange.

- Select “Receive” to select the cryptocurrency you are buying

- Select “Pay With”: to select the payment method. Make sure you have the desired amount of this cryptocurrency already deposited in your BlockFi wallet.

- Enter the amount of the crypto you would like to exchange.

- Click “Confirm Trade” to proceed

- Click “Submit Trade”

The short video below shows a simple BTC to USDC trade from start to finish.

Keep in mind that the trading feature is region-based and all of the trading pairs might not be available for everyone. And for the moment, the platform proposes crypto-to-crypto trading only.

BlockFi Crypto-Backed Loan Review

Next, you will learn about the crypto-backed loan feature’s pros and cons.

One of the major strengths of lending platforms such as BlockFi is the ability to provide liquidity to crypto holders almost instantly.

Through the platform, users can apply for a loan by putting their crypto holdings as collateral. The amount of the loan can go up to 50% of the user’s holdings.

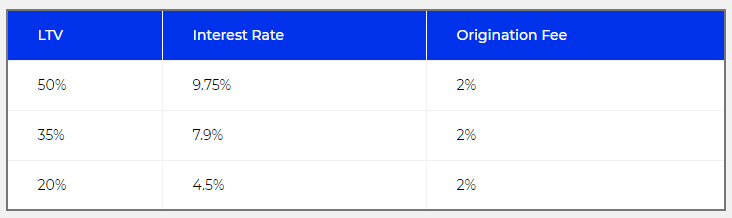

Depending on your loan-to-value ratio (LTV), different interest rates will be applied when you pay back your loan.

It’s an excellent way to gain access to hard cash for your Bitcoin, Litecoin, or Ethereum, without selling your funds on an exchange!

Additionally, BlockFi entirely relies on your crypto collateral for approving the loan and doesn’t require any credit check whatsoever.

And finally, you need to understand that BlockFi’s loans are interest-only loans. This means that you can repay only the interest rate if you so desire. You can also pay your loan in full whenever you want. What’s even cooler is that you won’t be charged an early-payment fee!

As a side note, it’s important to keep an eye on your LTV ratio when the price of your collateral cryptocurrency drops. If your LTV value reaches 70% or more, you will have 72 hours to add more collateral in order to keep your LTV to a healthy level. If your LTV level reaches 80% or more, BlockFi will sell a portion of your collateral to bring back your LTV to 70%.

How to use BlockFi Crypto-Backed Loans and how to get a loan at BlockFi?

Before we dig into how to get a loan on BlockFi the platform is licensed to give out loans to US residents only at the moment of writing. With that in mind, to apply for a crypto-back loan click on the “Borrow” tab in your dashboard.

There, you can fill in your loan application by choosing the collateral currency that you wish to use and the amount of the loan. Within a few hours, the BlockFi financial team will review your application, you will be presented with their decision and the steps you need to undertake to proceed.

BlockFi Wallet Review

BlockFi doesn’t propose a usable wallet like payment processors such as Skrill or Paypal.

Instead, you can use the BlockFi dashboard to:

- Store your funds

- Consult your portfolio and interest returns for each of your holdings

- Consult APY rates for all supported coins

- Deposit funds

- Withdraw funds

- Save an address list for frequently used withdrawal addresses

- Apply for a loan

- Trade between supported cryptocurrencies

So at the moment, the BlockFi app doesn’t allow users to pay with their crypto such as Bitpay. This might change soon, with the release of the upcoming BlockFi Visa Credit Card.

BlockFi Credit Card review

You will then be prompted to send your collateral to a unique crypto address. Once the transaction has been confirmed, BlockFI will wire the requested amount directly to your bank account.

There’s still very little information about the upcoming BlockFi credit card. Nonetheless, the benefits it proposes are pretty neat, such as the 1.5% cashback in Bitcoin for every purchase!

Unlike other crypto debit cards, BlockFi’s card will be a credit card. This means that users will be able to spend on credit and reimburse it in its entirety (without interest) or through monthly regular payments (with interest).

Every BlockFi user that has a funded interest account can join the waiting list for the credit card.

Cashing out from BlockFi

This BlockFi review would be incomplete if we didn’t go over one of the most important features of any lending platform – how to withdraw your funds!

How do I withdraw from BlockFi?

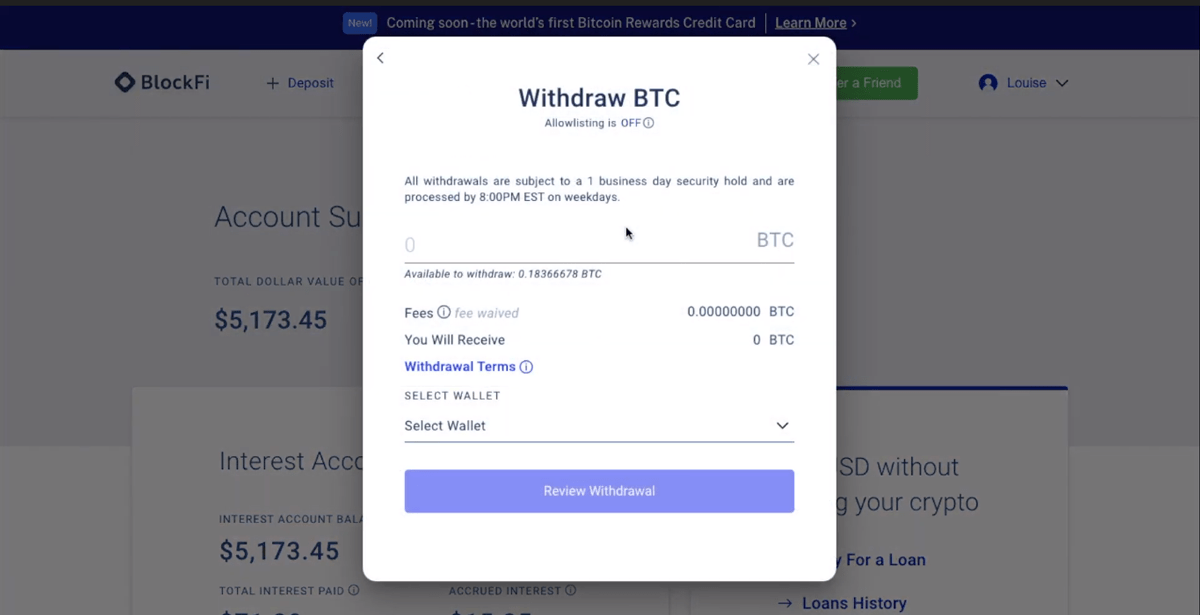

To withdraw your crypto from the platform, simply click on the “Withdraw” tab in your BlockFi dashboard to be met with the following popup:

Here, you will be prompted to enter the amount of the cryptocurrency that you want to withdraw from your BlockFi account. Additionally, you will need to enter the address of the wallet where you will be sending your crypto.

Keep in mind that all accounts are subject to the minimum withdrawal amounts of 0.003 BTC and 0.056 ETH. And as we previously mentioned, each user has the right to one free cryptocurrency and one stablecoin withdrawal per month. After that, you will be charged a withdrawal fee, which we already laid out in our “Fees” section of this post.

How long do BlockFi withdrawals take?

For security reasons, all withdrawals are subject to at least 1 business day review before they are approved. This manual review is deemed necessary by BlockFi as it reduces the chance of malicious party to defraud users of their money.

Additionally, transfers are only carried out on weekdays, so a transfer can take between 2 and 5 business days to complete.

BlockFi Referral and Promo Code

Now the next step is to Sign-up and test the service.

So, here’s your BlockFi Discount and Promo Code where you can get free 20 USD bonus:

- Sign up for BlockFi using this link.

- Or enter the referral code 7b8829b5,

- Deposit at least $100 on your BlockFi account.

- And you will receive 20 dollar bonus.

That’s it!

However, the opportunity doesn’t end there! You can share your referral code and get your friends to sign up for the platform. For each referral that deposits $100 or more, both of you will get a $10 bonus.

After 5 referrals, each new friend that signs up will net you a $20 bonus!

Pretty great, don’t you think?

Just keep in mind that your friend’s deposits will have to be held until the next payday for both of you to qualify for the bonus.

So, are You Ready to Take BlockFi for a Spin?

So that concludes our BlockFi review. We can say that BlockFi is a potential bridge between the traditional financial system and crypto.

Its interest account offers a secure platform where your funds can be stored, and make profits while just idling in your wallet.

Another big advantage of BlockFi is the crypto-backed loans feature, which allows you to access cash by collateralizing your crypto in just a couple of hours.

Not everyone is comfortable in keeping their crypto private keys themselves, and BlockFi gives beginner crypto investors a great way to enter the market. Thanks to its simple to understand features, anyone can start earning interest on BlockFi.

So why not get started right away?

FAQ section

Below are answers to some of the most frequently asked questions about

BlockFi. You might find everything related to the crypto lending platform that we didn’t cover in our BlockFi review.

Is BlockFi Safe?

Yes, BlockFi is a legitimate business and it’s entirely safe to store your funds. Just keep in mind that as with all centralized platforms, you might lose access to your funds for many reasons, such as breaking the EULA or if your account shows any suspect behavior.

Is BlockFi decentralized?

No, BlockFi is not a decentralized platform. When you transfer funds to BlockFi you are giving custody of your money to a third party, in this case, the Gemini exchange.

Is BlockFi an exchange?

No, BlockFi is not a cryptocurrency exchange. However, the platform proposed a trading feature where users can swap some popular cryptocurrencies with zero fees.

Is BlockFi a wallet?

No and yes, BlockFi is not a cryptocurrency wallet and it cannot be used for electronic payments such as Bitpay or Coinbase Commercial but you can definitely store your cryptocurrencies on BlockFi.

Can I buy Bitcoin on BlockFi?

Yes, you can buy Bitcoin on BlockFi. However, you can’t do this directly as it requires a small workaround (explained in the question below).

How can I buy Bitcoin on BlockFi?

Here’s the full procedure on how to buy Bitcoin on BlockFi:

- First, you will need to deposit some USD by using the wire transfer method.

- Your cash will automatically be converted into the GUSD, which’s a stablecoin.

- Then, by using the Trading Account option, you can swap your GUSD for Bitcoin, without suffering any additional fees.

How secure is BlockFi?

BlockFi is quite secure as the main custodian of your funds is the globally famous Gemini exchange. They keep 90% of their funds (and yours!) in cold storage and have a SOC2 Type 1 compliance, proving their dedication to security even further.

How long does it take to withdraw from BlockFi?

Withdrawals are always reviewed manually and take at minimum 1 business day to be executed. Furthermore, they are only carried out on weekdays, so a transfer might take between 2 and 5 business days.

How often is BlockFi interest paid?

BlockFi earned interest is paid out on a monthly basis, on the first business day of the month.

What are BlockFi alternatives?

A great BlockFi alternative is Celsius Network. It offers a very similar service and very good interest rates for your investment. Here’s Celsius Review so you can check if it’s something you would like to test as well.