Monese Review Updated 2021

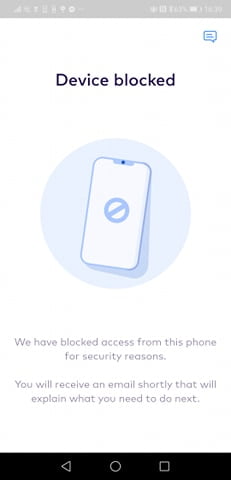

I was a user of Monese for over 2 years and they blocked my account and my device from accessing the App.

And the worst thing is – I cannot access my money and their support does not reply to my messages.

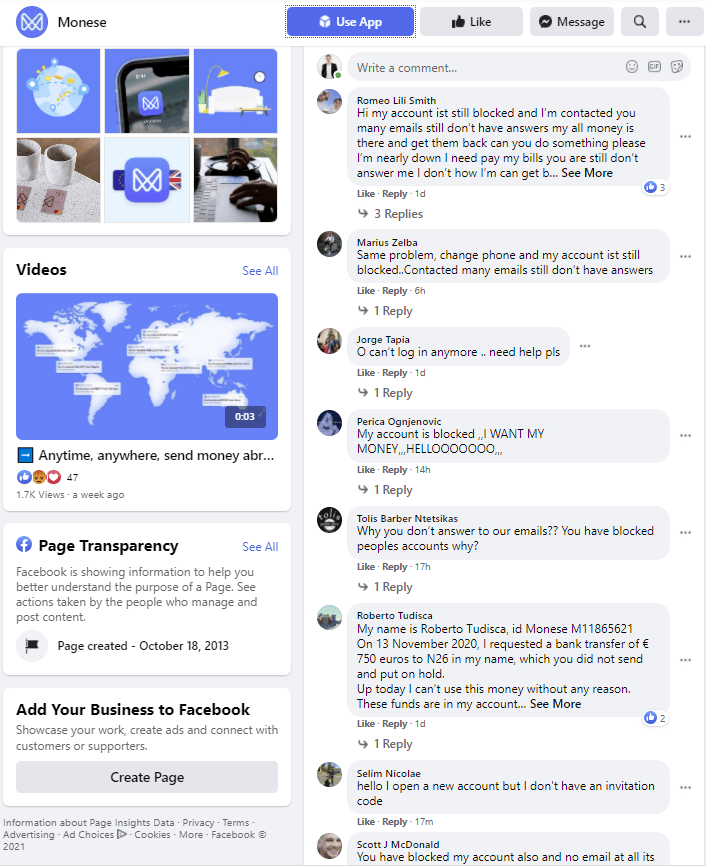

In fact, their Facebook account is full of people complaining about their wrongdoings.

So, save yourself headaches and choose another digital bank 😉

Lucky for you, we put together a list of digital banks that you can use as alternatives.

I have used these banks for several years and know for sure they don’t do shady things like Monese.

Nonetheless, if you are not afraid that your account will be deleted one day and their support won’t be replying to your messages – keep reading.

This Monese Review is as unbiased as it can be 😉

Spoiler alert: for the people who are reading this article only to get Monese Invite Code (& get 25 USD/EUR bonus) – here it is:

Monese Invite Code

Not here to waste your time.

So, if you are looking for Monese Sign up Bonus – grab the code from below 😉

Simply type in the App – HELVI738

And you’ll get your 25 USD/EUR Sign up bonus.

You can thank me later 😉

*But in case you need a detailed guide on how to apply Monese Invite Code – click here.

Monese Review

Ok, let’s continue.

For the others:

- Who are here to find out is Monese Safe?

- How to get started with the App

- And how to order your Free Monese Card

Keep reading.

That’s what you will find in this article – we’ll review the good, the bad, and the ugly of Monese.

What’s more, this is just a tip of the iceberg – this borderless bank offers so much more.

So, in this Monese review we’ll check out all the amazing features:

- How to get started,

- Is it safe to use,

- Review all the benefits of Monese,

- And step-by-step on how to receive your Sign up Bonus using our Invite Code.

So, let’s dive in!

What is online banking (& should you care?)

The main disadvantage of traditional banks are their operating costs. Branch office space needs to be rented or bought, tellers that communicate in person need salaries, etc.

That’s where online banks come into play.

In addition to offering the same security and easy access to your funds, they can offer these services with reduced fees on transfers and account management.

Here, we’ll be talking about Monese in particular, a UK online bank that allows you to open a bank account without proof of residence or income requirement. I’ll try to go through all of the features that Monese offers, see who it’s for and what are its main pros and cons compared to the competition.

So, stick around for this detailed review if you need to make up your mind if Monese’s services are something you might consider for your personal use.

Is Monese Safe?

Monese is a British mobile bank that started operations in September 2015.

It was the first UK online-only bank and has since fanned out its services throughout the whole EU.

What distinguishes Monese from conventional banks is that their services can only be accessed through their mobile application.

Every transaction is done through your phone alone. But taking this mobility even further, they allow customers to create an account without a fixed UK address.

This is the feature that makes Monese pretty unique.

Anyone residing in continental Europe can open an account right away, whether or not they have UK credit history.

The app can be used in 20 different EU countries, rendering working travel even easier. Wherever you go, your Monese account comes with you.

With Monese you get the ability to receive your salary, shop online, make purchases at stores, and withdraw cash from ATMs.

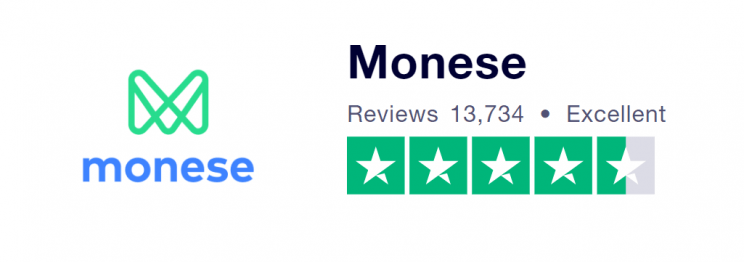

So, it’s pretty safe and their user ratings on Trupilot are excellent– https://www.trustpilot.com/review/www.monese.com

And without further ado, let’s go through the main features that are offered to their customers.

What Monese offers

- Free Bank account. You can open an account in a couple of minutes just by downloading the app. No proof of residency or income is required, just an ID card or a passport is sufficient.

- A contactless Mastercard Classic credit card associated with the account. It allows all the usual operations (payment, withdrawal, etc.) and can be used anywhere in the world with all merchants that accept the Mastercard network.

- An innovating mobile app that offers a wide array of features on how to manage your account. We will discover in greater detail further down in this review.

On top of that, if you signu-up NOW you get 25 USD or EUR.

Seem like a no-brainer, right?

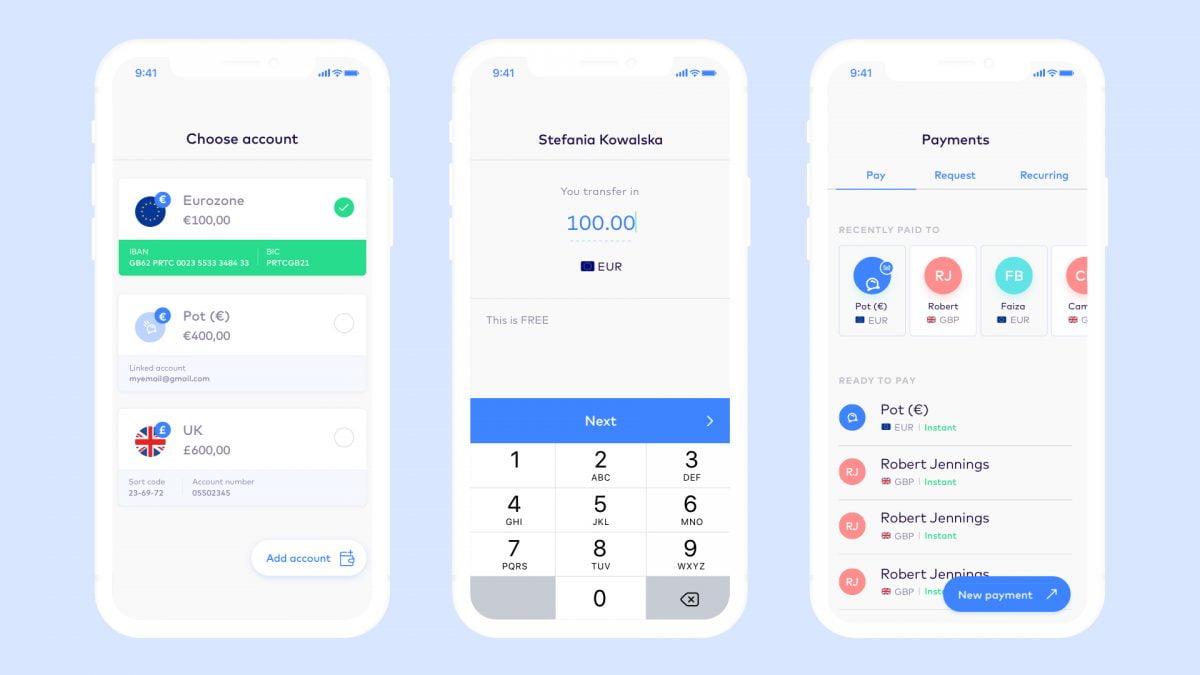

The Monese Mobile app features

Account and Expenses Management

- Opening and closing the account in minutes.

- Real-time overview of your account balance.

- Transaction notifications.

- Statistics and categorization of expenses.

- Fingerprint authentication.

Credit Card Management

- Lock and unlock your card in real-time.

- Secret codes management.

- Change the payment and withdrawal limits.

- Details of where every payment with the card was made.

Transactions Management

- Make transfers in EUR, GBP or other currencies directly from your smartphone

- Instant payments Google Pay and Apple Pay

- Top-Up: use your credit card for an instant refill of the account

- Instant transfer between 2 Monese accounts

Monese Fees & Pricing

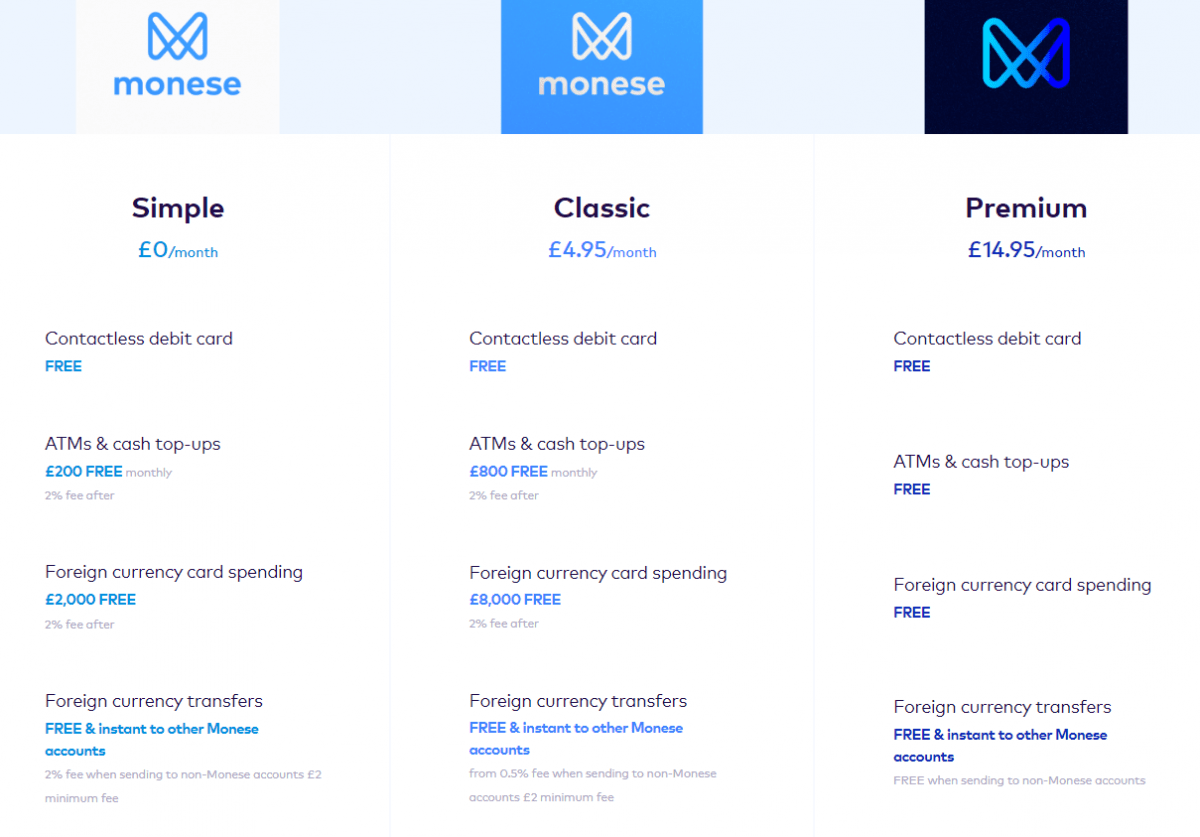

Monese offers three different pricing plans Simple, Classic and Premium.

And depending on which plans you choose, those are the only Fees you’ll need to pay.

Sounds pretty cool compared to your normal Bank which charges monthly, per transaction, and on withdrawals, huh?

Here’s a the Fee overview:

1. Simple – FREE

- Transfers are free up to £2.000 a month (2% fee after).

- ATM and Cash top-ups are FREE up to £200 a month (2% fee after).

- Foreign transfers are free between Monese accounts, a 2% fee is applied to all others.

This free plan is perfect for someone just needing a quick access to financial services and doesn’t do a lot of transfers. Great for students or short-time ex-pats.

2. Classic – £4.95Month

- Transfers are free up to £8.000 a month (2% fee after).

- ATM and Cash top-ups are FREE up to £800 a month (2% fee after).

- Foreign transfers are free between Monese accounts, a 0.5% fee is applied to all others.

Here, the small fee is very acceptable for the big jump in limits. Perfect for middle-salaried workers that need to transfer larger amounts of money to their families or are in general in need of more working capital monthly.

3. Premium – £14.95Month

- All limits are lifted and all fees are waived.

The higher monthly subscription justifies the elimination of the transfer fees in percentages. For anyone making transfers over €10.000, this is the plan to get.

Monese Top-up Limits

The monese debit card has fixed transactional limits for daily operations:

The Monese account maximum balance limit is €50.000. There are also different limits on cash top-ups:

- Instant Debit card top-up: 300 EUR per day.

- If you wish to top-up using a debit card then these are the limits:

- In Pounds: 300 GBP daily, 600 GBP weekly, and 600 GBP monthly

- In Euros: 350 EUR daily; 700 EUR weekly, and 700 EUR monthly

- There are also Cash topups via Post Office: that’s 500 GBP or 580 EUR per transaction per day

- And Cash topups via PayPoint: that’s 249 GBP or 290 EUR per transaction and 500 GBP or 580 EUR per day

These are all the Monese Top-up limits you should be aware of.

Monese Withdrawal Limits

- Cash withdrawal via ATMs: 255 GBP or 350 EUR per day.

- Card payments are limited to 3 000 EUR or 2 550 GBP per transaction and 7000 EUR or 5 950 GBP per day.

- SEPA transfers are limited to 10 000 EUR or 8 500 GBP per day (these are transfers made from an Euro bank account)

This should cover everything there is to know about Monese Withdrawal Limits.

Monese Savings Account Review

Monese offers a place where you can safely keep your savings separate from your day-to-day spendings.

These so-called “Monese Pots” do not offer any interest when you put funds into them, but at least kkep you safe from spending money you wanted to keep for a rainy day if stored in a “pot”.

How to get Monese Invite Code?

For the ones who are reading this post only to get Monese Sign up Bonus – will keep it simple for you.

Here it is – HELVI738

For the ones who are ready to get Monese’s Bonus but need a guide on how to do it.

Here’s a detailed guide we made for you.

To earn 25 EUR (or USD or GBP – in all currencies it’s almost the same), you need to open Monese Account.

All you have to do is – sign-up using this URL or enter this code – HELVI738.

Next you will need to do the following:

Step 1: Sign-up and order you Free Monese Card

Follow the guide down below and order your card.

Step 2: Verify your identity and the necessary information

**In case, you are having trouble completing the verification or any of the steps – here you can find the sign-up process with detailed screenshots.

Step 3: Apply The Invitation Code

Open the ‘Earn’ section of the app. Then share your invite link or send the QR code so your friends can scan it.

Step 4: Get your friends to sign up

They will be prompted to open an account and receive their free debit card. And after their first transaction your friends will be rewarded with €25 Sign up Bonus!

Once they top-up and use their account for a purchase, you will both receive a €25 gift into your respective Monese accounts.

Cool huh?

If you didn’t click on the button below to get your invitation code

Which Online Bank to Choose – Monese Compared vs. Other Online banks

Nowadays there are so many online banks to choose from – so in this Monese review, we’ll compare other online banks with Monese.

To show if you are making the best choice?

Monese vs N26

N26 is a digital bank that started in 2013, making it the first European online bank. Established in Berlin, it is now available in a wide array of European countries and operates in the UK since 2018 as well.

| Monese | N26 | |

| Pros | – Simple to open an account, without credit history or address, perfect for travelers in the EU. – Available in a lot of languagesOffers both EUR and GBP accounts – Allows you to top up your account with cash (UK) |

– Available both on web and on a mobile app – Offers interest on savings – Deposit protection up to €100.000 |

| Cons | – Starter plans have fees once the limits are reached – Doesn’t offer additional banking services like interest or overdraft |

– Customer service only available through the in-app live chat – Potential re-verification issues1.7% flat fee for foreign currency withdrawals – Some advanced services are only available to German customers |

Although both banks offer similar services and are pretty closely matched when it comes to features. If you aren’t residing in Germany or Austria, Monese might be the better choice because of the fee-free plans and the freedom of not having to confirm an address.

Monese vs Revolut

Revolut has become really popular, especially with the fact that their card supports a large variety of currencies and even some of the top cryptos. But the extra fees on weekends can add up quickly and you might want to review your card usage before you make a decision.

| Monese | Revolut | |

| Pros | – No address verifications needed to open an account, just to receive your card – The Card is free – Simple pricing method for international transfers |

– Can hold up to 29 different currencies – Supports 5 major cryptocurrencies – No Fees on card usage when abroad – Offers virtual cards |

| Cons | – No virtual cards – Limited currency support (EUR and GBP) |

– Charges you for the card delivery – Extra Fees on Weekends – You only get local account details for your country of residence |

Revolut has become really popular, especially with the fact that their card supports a large variety of currencies and even some of the top cryptos. But the extra fees on weekends can add up quickly and you might want to review your card usage before you make a decision.

Monese vs Bunq

Bunq is a mobile bank based in the Netherlands. They provide a wide array of features built-in directly in their mobile app, like opening up to 10 different accounts, budgeting etc.

| Monese | Bunq | |

| Pros | – Low fees on withdrawals and transactions – Fast and easy set-up (no credit check or proof of local address needed) – Free card payments and ATM withdrawals abroad. |

– Wide range of financial services – Built-in savings and interest on account balances – Free money transfers in Euros – Can open up to 25 different accounts to manage your funds and expenses |

| Cons | – With a free plan, fee-free ATM withdrawals and cash loads are limited to €200 per month. – No option to earn interest on savings. – Joint accounts for UK users only |

– Most services aren’t accessible with the free plan, apart from the travel card which costs a flat €9.99 fee – Maximum 10 ATM withdrawals/monthEUR account, whenever you transfer to another currency, exchange rates are applied |

Bunq doesn’t offer a free service, only a premium one for a 7.99EUR per month. This means that unlike with Monese, you will have to subscribe out of the bat, which might put off a lot of people.

It is also an EUR account only, so it will be a hassle if you are receiving your salary or making transfers to other currencies.

Monese vs Monzo

Monzo is one of the digital banks that can really replace your bank, given that you live in the UK. It is considered the most popular at the moment, with more than 3 million customers.

| Monese | Monzo | |

| Pros | – No hidden fees, you get what you pay for – Decent free plan that gives you all that you should expect – Great customer support in a variety of European languages (more than 10) |

– Emergency desktop access in addition to the mobile app – Transaction categories and pots for budget management and interests on savings – Good reputation and support – Can get a loan through Monzo on the same day you open your account |

| Cons | – No spending categories – No overdrafts or savings interests. |

– Only for UK residents – 3% fee for ATM withdrawals abroad once the €200 limit is exceeded. |

Maybe the biggest challenger to Monese, Monzo can really replace your bank account… given you are a UK resident. Otherwise, as an expat or a traveler, you will have a hard time opening an account as there are credit and address checks.

Monese vs Starling

Starling is another very popular online bank in the UK. It offers a full banking account that can be opened and managed through their app. Similar to the other digital banks, their goal is to make banking easier and more accessible for the customer.

| Monese | Starling | |

| Pros | – GBP and EUR accounts available Available for EU residents. – Slick and appealing mobile app – Great visibility of your spending through the “instabalance” feature |

– No monthly fees – Loans and overdraft available to eligible customers – Decent interest rates offerings |

| Cons | – No loans, overdrafts or interests – ATM fees apply once the plan limits are exceeded |

– UK residents only |

Starling offers very good services and a very appealing no-fee approach to them. The problem resides that it’s limited to UK residents only, which really narrows down their customer base

Now that we saw some of the main pros and cons versus the competition, we can give our verdict:

First, we can say that all of these online banks offer apps that are modern, easy to use and packed with features.

Monese offers a good variety of services with their free plan and their transfer and ATM withdrawal fees are some of the lowest. In addition, both the fact that you don’t need to confirm your address and that the app is available to EU citizens makes this a great choice for most European travelers in and out of the UK.

Some of the online bank competitors do offer a wide array of services like interests on savings, loans and overdrafts, but they are often limited to residents of a particular country and locked behind monthly fee paywalls.

All in all, Monese is a great all-arounder that offers a great online banking experience for a wide range of European countries, not only the UK, unlike some of the competition.

How Monese Works

So, by now it should be clear that Monese is one of the best online banks you could choose from.

Thus, here’s how to get started.

The first thing you need to understand is that Monese is an app-only banking platform. There are no physical branches where you can speak to tellers, no website that you can visit to consult your balances. The only way to access your account will be through your smartphone.

And that’s great – because from the Monese App, you can access your bank 24/7 to get any info you want.

So, here’s how to get started.

How to start using Monese? (with screenshots)

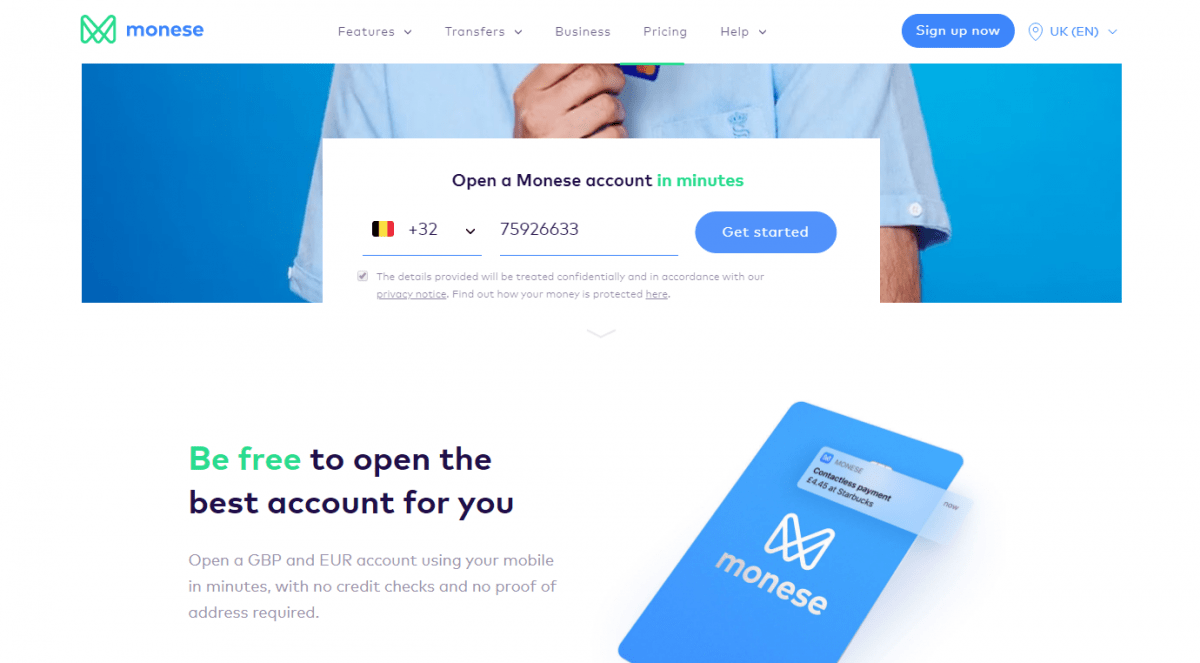

Step 1: First, you need to visit the Monese website.

Step 2: Once on the homepage, select your country code and enter your phone number. Tick the box to confirm that you agree with the confidentiality agreement and press “Continue”.

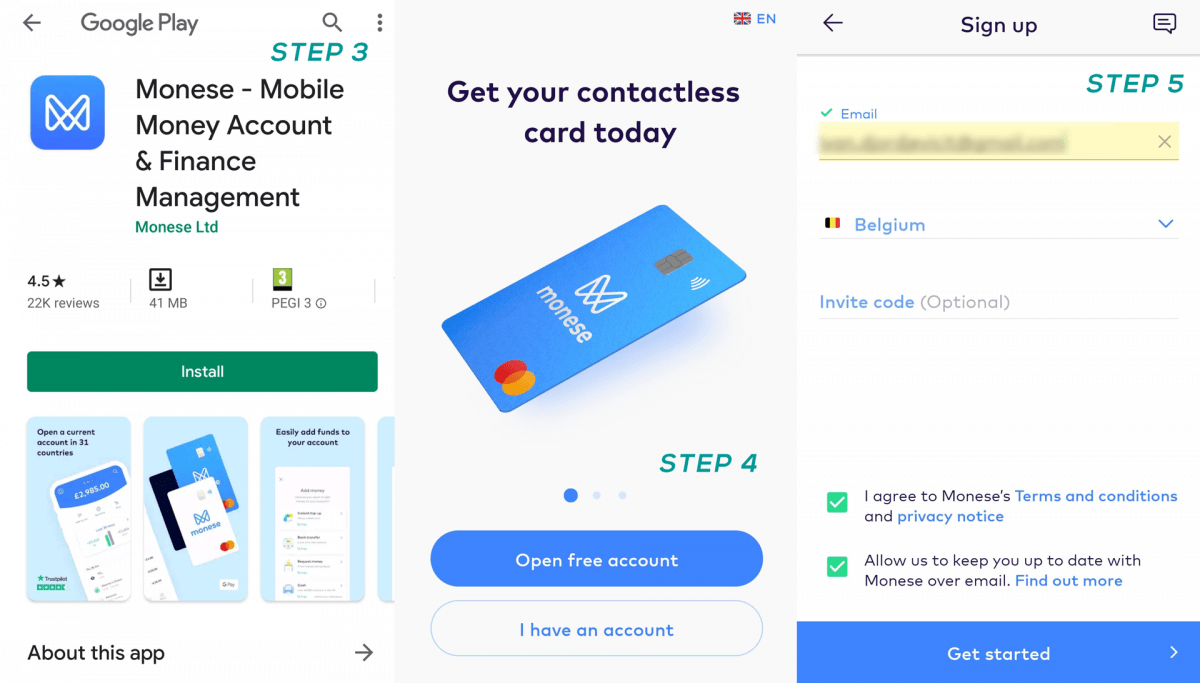

Step 3: The system will send you an SMS on your phone with a link to the Monese mobile app for your phone. Follow the link and press “Install” to proceed.

Step 4: Once the app is installed, open it. Tap the “Open free account” to begin.

Step 5: Fill in your email, country of residence and invite code if you have one and tap on “Get Started”

Step 6: Create a 5-digit passcode and enter all of the mandatory information in the sign-up form and Continue.

Step 7: Uploading a document. Select the country of issuance and then the document that you want to upload. The app will ask you to take a picture of the front and back of your ID. Make sure your pictures are not blurry and that the photo and text are clearly legible.

Step 8: Wait for verification. When asked, make a short video of yourself as instructed on screen.

Step 9: Once the verification is done, select your plan, and proceed to order your card.

Step 10: And you are done – Order your Monese card.

Just make sure the address you’ve entered is correct and confirm. Once you receive your card, enter the activation code that arrived with it and you will be able to use your Monese account.

To get started and to get your Monese Card with 25USD/25GBP already there.

Simply click here.

Who should use Monese?

Monese allows its users to simultaneously use a GBP and EUR account, without having to confirm a residential address or any credit or revenue proof. All of this in under 15 minutes!

I guess you can see where we’re going with this. Monese is the ideal solution for expatriates that are moving to the UK, whether they are working people or students. It helps workers get their salary in GBP and transfer it in EUR to their families, while students can use the card for daily expenses with reasonable transaction fees.

But, as Monese is also available in other countries, this isn’t the only option. It allows European residents that like to travel to access an online bank without a fixed address. This helps people that need mobility with their money to bypass the administrative burdens of opening different bank accounts and stop wasting time when using basic financial services.

Frequently Asked Questions

Just in case if some questions were not ansered in this Monese Review – here are the answers to most freaquently asked questions.

Can I trust Monese?

Monese has an effective customer service that answers your questions in 12 different languages. They have been known to be fast and responding precisely to whatever issue customers might be facing. Furthermore they have an excellent 4.5/5 Trustpilot score, with over 13.000 reviews, which proves that they take care of their customers and that they provide a satisfactory service.

Is Monese legit or is it a scam?

Monese is regulated by the Financial Conduct Authority in the UK and uses best practices to protect your money and secure your personal information. Your accounts can only be accessed from a single mobile device which prevents other people from accessing it in any way.

Additionally, Monese doesn’t reinvest your money like other banks and keeps customer’s funds separated from their own finances. So even if the company goes bankrupt, you should recover 100% of your capital.

To conclude, Monese is legit and your money will be safe with this online bank.

Can I use Monese abroad?

Yes, you can use your card for withdrawals and purchases abroad, and your account for transferring funds to the list of supported countries.

What are the Monese ATM withdrawal limits?

Monese has a €350 daily withdrawal limit from ATMs. Do note that these are independent of your pricing plan. Pricing plans play on your monthly withdrawal limit and the fees you will be paying if you exceed them.

What’s the maximum amount you can hold in your Monese account?

The maximum you can hold in your UK monese account is £40.000. For your EU account, the maximum balance you can have is €50.000, with France as an exception with €10.000 maximum.

Is Monese Free?

Monese offers a Starter pack that is free to use, and they send you a card that is also free of charge. Be careful though, as not all features are free under a Starter plan:

Free Features :

- UK Faster Payments and SEPA payments in EU

- Card usage in home currency

- Direct Debits (UK)

- UK and Eurozone accounts with personalised account numbers

Paid Features:

- ATM cash withdrawals are £1/1€ each

- For the UK, Cash top at PayPoint are 3.5% and 2% at Post Office

- Minimum 2% base FX rate (minimum fee £2/€2) on international transfers and ATM usage

- 2% base FX rate on card spend abroad without minimum fees

Wrapping Up on Monese Review

I sincerely hope that this review answered all of your questions that you might have about online banks and Monese in particular.

To summarize, Monese is a great online banking service for everyone, with easy access and an awesome mobile app packed with useful features.

On top of that, if you are travelling in and outside the EU – it’s a must get as you will save a ton on fees.

Monese’s no-nonsense approach makes it a solid choice as your financial travel app.

Ready?